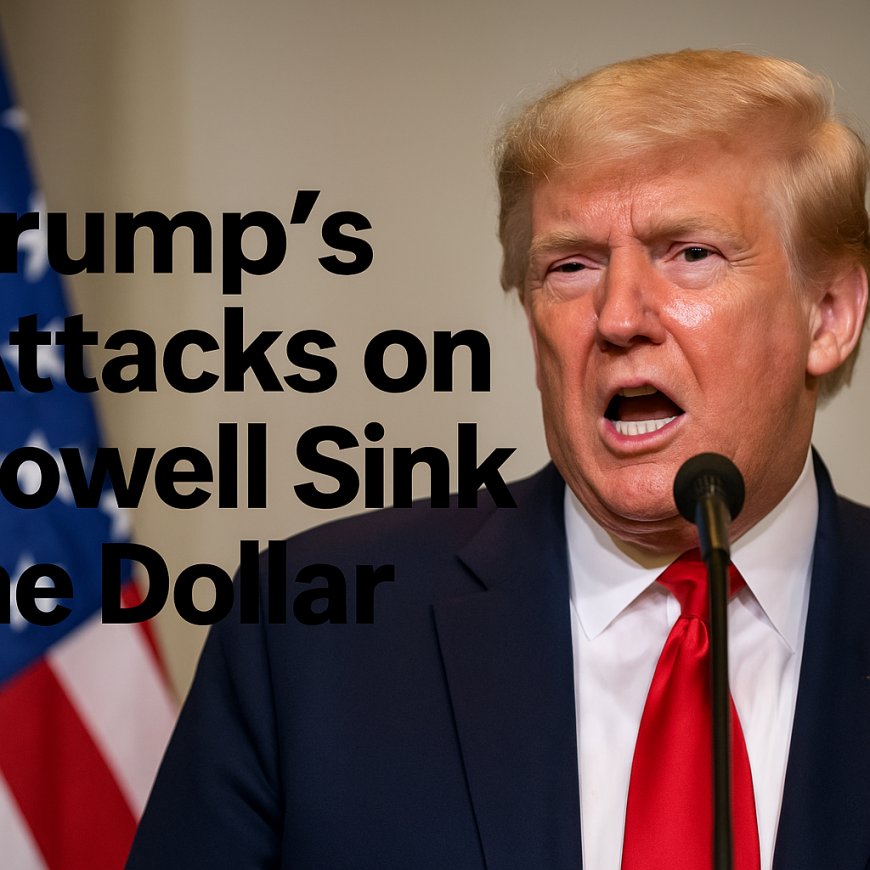

Trump's Attacks on the Fed Spark Historic Dollar Collapse and Global Economic Uncertainty

Donald Trump's attacks on Federal Reserve Chair Jerome Powell have triggered a significant drop in the U.S. dollar, raising global economic concerns.

The U.S. dollar has plunged to a three-year low following a series of aggressive verbal attacks by former President Donald Trump against Federal Reserve Chairman Jerome Powell. Trump criticized Powell for not cutting interest rates, calling him a "big loser" and questioning the central bank's independence. These remarks have sparked widespread market volatility, investor anxiety, and international responses, further complicating an already fragile global economic landscape.

Background: Tensions Between Trump and the Federal Reserve

The conflict between Trump and Powell is not new. During his presidency, Trump frequently pressured the Fed to implement rate cuts, arguing that lower rates would boost economic growth and stock market performance. Despite his efforts, Powell maintained a cautious approach, prioritizing inflation control and long-term financial stability.

The Immediate Impact on the Dollar

Following Trump's recent comments, the dollar fell sharply against other major currencies. On Monday, the euro traded at $1.15, its highest level against the greenback in three years. Similarly, the U.S. dollar weakened against the Australian dollar, which is heavily linked to China's economic activity. These shifts indicate a broad-based decline in confidence in the U.S. currency.

Investor Flight and Market Reactions

Uncertainty surrounding Trump's tariff policies and his interference with the Fed has led many investors to withdraw from U.S. markets. The S&P 500 has experienced its worst opening performance of any U.S. administration since 1928. Bond markets are also under pressure, pushing long-term interest rates higher and increasing borrowing costs for consumers and businesses alike.

"Sell America": A Growing Trend

Financial analysts are now using the term "Sell America" to describe the growing trend of divestment from U.S. assets. The destabilizing effect of Trump's trade wars, rising deficits, and political unpredictability is prompting global capital to flow toward more stable markets. This trend is hurting the perception of the U.S. as a safe haven for investment.

Corporate Uncertainty and Consumer Confidence

Major U.S. retailers such as Walmart, Target, and Home Depot are caught in the middle of the tariff turmoil. Trump's surprise meeting with these corporate leaders aimed to address concerns over rising import costs and dwindling consumer confidence. Many businesses are unsure whether to hire, invest, or increase inventory as they await clarity on future trade policies.

Inflation and Employment Concerns

Economists warn that the current economic environment may lead to inflationary pressures and job losses. If tariffs continue to rise and the dollar weakens further, the cost of imported goods will increase, raising prices for consumers. Some analysts predict that the U.S. could enter a recession by the summer if conditions do not stabilize.

China's Response: A New Phase in the Trade War

China has announced that it will oppose any trade deals with the U.S. that harm its national interests. The Ministry of Commerce in Beijing issued a statement threatening reciprocal actions against nations aligning with Trump's protectionist agenda. Chinese businesses, including restaurants in Beijing, are already phasing out American beef in favor of alternatives from Australia and Canada due to rising prices.

The Ripple Effect on Global Trade

With nearly 80% of U.S.-China trade affected by tariffs, both nations are feeling the consequences. The shift in supply chains is becoming apparent as Chinese importers seek cheaper sources for products previously bought from the U.S. Australian beef is now 40% cheaper than U.S. imports, helping fill the void left by American suppliers.

India and the Strategic Pivot

In response to deteriorating trade ties with China, the U.S. is turning to India. Vice President JD B visited New Delhi to discuss a potential bilateral trade agreement aimed at counterbalancing China's influence. India, which imported over $42 billion in U.S. goods in 2024, has expressed willingness to lower tariffs on more than half of those imports. Negotiations are underway to finalize a roadmap for reciprocal trade.

Mexico's Response: Cutting Red Tape

Mexican President Claudia Sheinbaum has introduced a law to reduce bureaucratic hurdles and fight corruption through a digital one-stop investment platform. This move seeks to attract foreign investors disillusioned by the U.S.'s protectionist stance. The plan, dubbed "Plan Mexico," aims to strengthen Mexico’s position as a reliable trade partner.

International Organizations Weigh In

The IMF and World Bank have both expressed concern over Trump's economic policies. During their spring meetings in Washington, they warned that rising protectionism and volatility could slow global growth. IMF Managing Director Kristalina Georgieva forecasted a global slowdown, increased inflation, and mounting uncertainty, stopping short of declaring a full-blown recession.

Symbolic Repercussions and Market Sentiment

Even symbolic events are underscoring the fragility of the current economic climate. The New York Stock Exchange held a minute of silence to honor the passing of Pope Francis, a rare gesture that reflected the somber tone across markets already rattled by political chaos and policy instability.

The Long-Term Impact of Trump's Economic Tactics

Trump's public clash with the Federal Reserve, coupled with aggressive tariff policies and disregard for institutional independence, is reshaping the global economic landscape. As the dollar continues to fall and international partners distance themselves, the credibility and influence of the U.S. as an economic leader are at risk. Investors, consumers, and policymakers alike are bracing for a prolonged period of adjustment—and possibly, economic pain.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0